Anti Money Laundering Policy Template. This Anti-Money Laundering Policy is designed for a low risk business that wishes to put in place a general policy in order to make staff aware of money laundering, prevent money laundering taking place and what to do should any money laundering activity be suspected. The operations of the Company and its subsidiaries are and have been conducted at all times in compliance with all applicable financial recordkeeping and reporting requirements, including those of the Bank Secrecy Act.

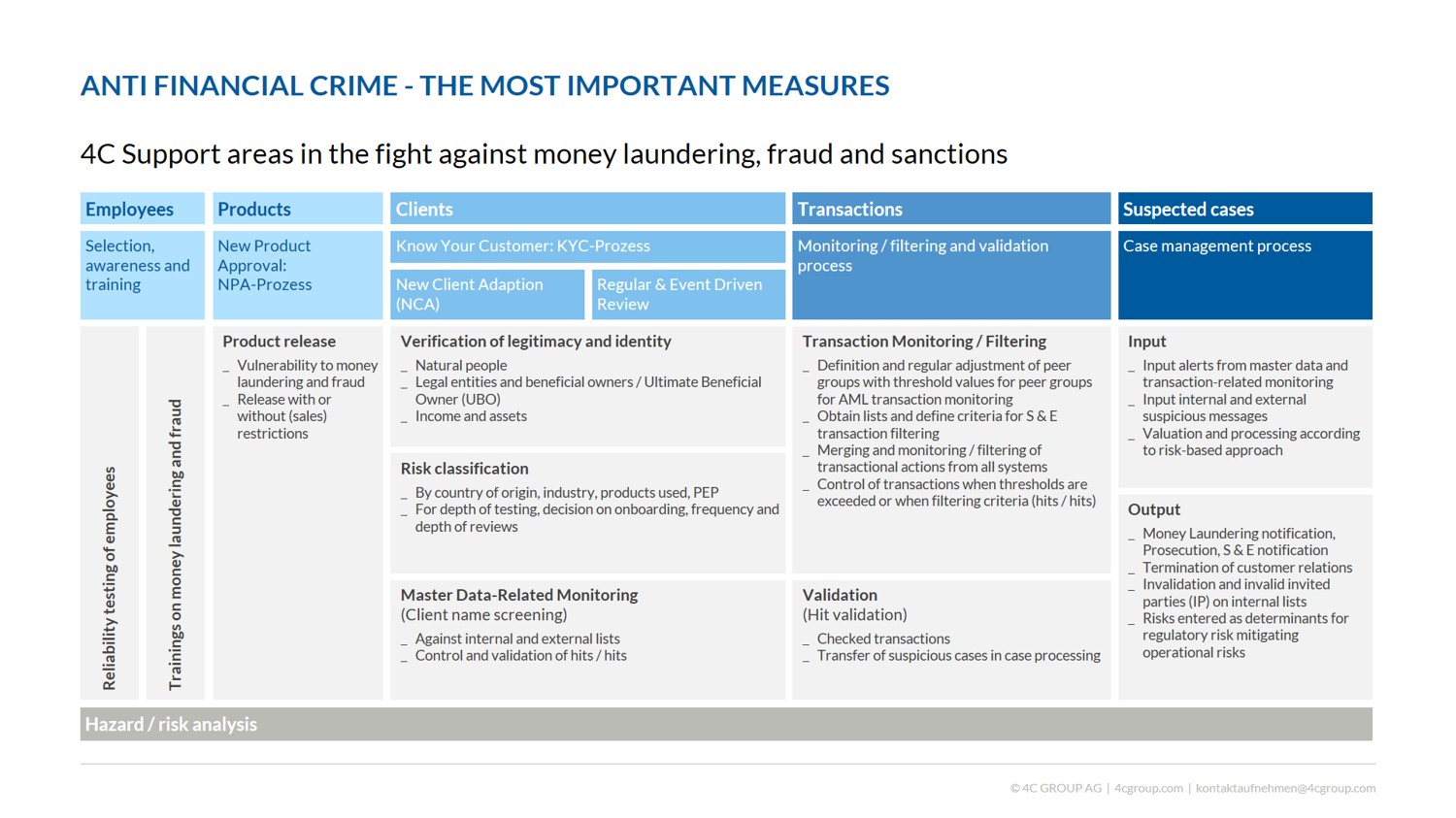

Anti-money laundering policy is a combination of measures used by a financial institution to stop the reintroduction of the proceeds of illegal activities.

Countering the financing of terrorism handbook.

FinCEN further encourages MSBs to adopt policies and procedures that incorporate the Basel Committee Statement of Principles on Money. If they come across any information that appears to be suspicious, they are required to report it to the government for further investigation. Anti-money laundering (AML) refers to efforts to prevent criminal exploitation of financial systems to conceal the location, ownership, source, nature, or control of illicit proceeds.

.jpg)